IBM Can't Acquire Its Way Into Tech's Top Ranks

A deal for software provider Apptio will boost the company's cloud business but still leave it trailing the industry's AI innovators.

June 27, 2023

(Bloomberg Opinion/Dave Lee) — On the face of it, there isn't much wrong with International Business Machine Corp.'s $4.6 billion deal to buy software provider Apptio. The acquisition is the seventh made by Big Blue this year, part of Chief Executive Officer Arvind Krishna's continued effort to pivot the 112-year-old company away from its legacy business of IT infrastructure.

Yet the deal did little to inspire investors. IBM's share price rose by just 1.48% on Monday following the deal's announcement. The shares are down around 7% since the beginning of the year, well behind the S&P 500 and certainly not enjoying the artificial intelligence bounce seen by other tech giants.

It has been a steep comedown for a company that was once expected to lead the AI revolution. A quarter century ago, IBM dazzled the world with Deep Blue, a computer that could beat a chess grand master. More than a decade ago, its supercomputer Watson bested a Jeopardy champion. There were high hopes that the technology powering these machines would propel IBM into the forefront of business adoption of AI. Yet the company failed to capitalize on its early success. When a mesmerizing AI technology was finally released into the wild last year, it wasn't IBM but by a relatively tiny venture, OpenAI, the startup behind ChatGPT.

IBM-acquisitions

That's not to say AI isn't part of IBM's business. It offers clients call center management and HR tools that are greatly enhanced by AI and therefore require fewer human workers. Indeed, earlier this year, IBM disclosed that it would enjoy the labor-saving benefits itself, saying it was pausing or slowing the hiring of its own back-office roles due to improving automation capabilities. Krishna said at the time that he could envision thousands of IBM jobs being replaced by AI and automation.

Some observers questioned whether that framing was a cover for an old-fashioned hiring freeze, but few would disagree with the general trajectory of those kind of jobs. "I think AI will probably will improve productivity internally at IBM," suggested Moshe Katri, an analyst at Wedbush. "But are they a leader in AI? They're not."

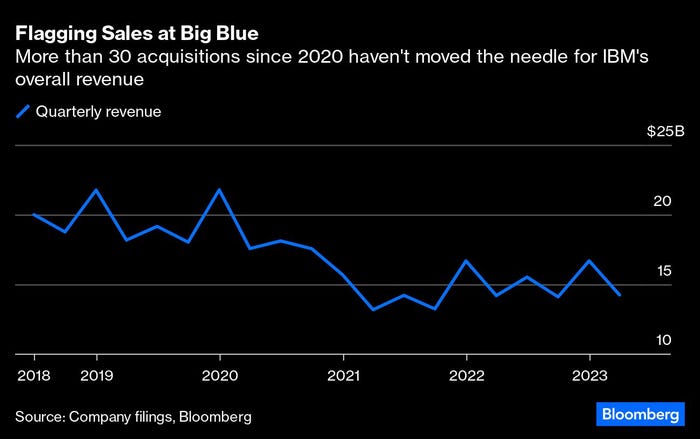

IBM's declining relevance has brought with it one benefit: Bigger companies including Amazon and Microsoft are facing intense antitrust scrutiny by regulators, constraining their deal-making potential. In contrast, IBM has managed to pull off more than 30 takeovers since the beginning of 2020.

The latest, Apptio, will be a boost IBM's "hybrid cloud" offering, where companies store data both in the cloud and on their local servers. IBM moved into the space with in 2019 with its largest-ever acquisition, a $34 billion purchase of Red Hat.

Apptio's software helps companies optimize how they store and move data between services. With companies facing growing cloud costs, the hybrid setup is an attractive option.

Still, at about $400 million to $500 million a year, the expected revenue increase from Apptio would represent less than 1% of IBM's total, hardly enough to offset declines elsewhere. IBM's revenue grew less than 1% year-on-year in the most recent quarter ended in March. That speaks to why investors are less than enthused by this and other takeovers.

About the Author

You May Also Like

.jpg?width=700&auto=webp&quality=80&disable=upscale)